What is a budget and why do I think everyone who wants to save more money needs one? We will answer these questions and more in the following blog post.

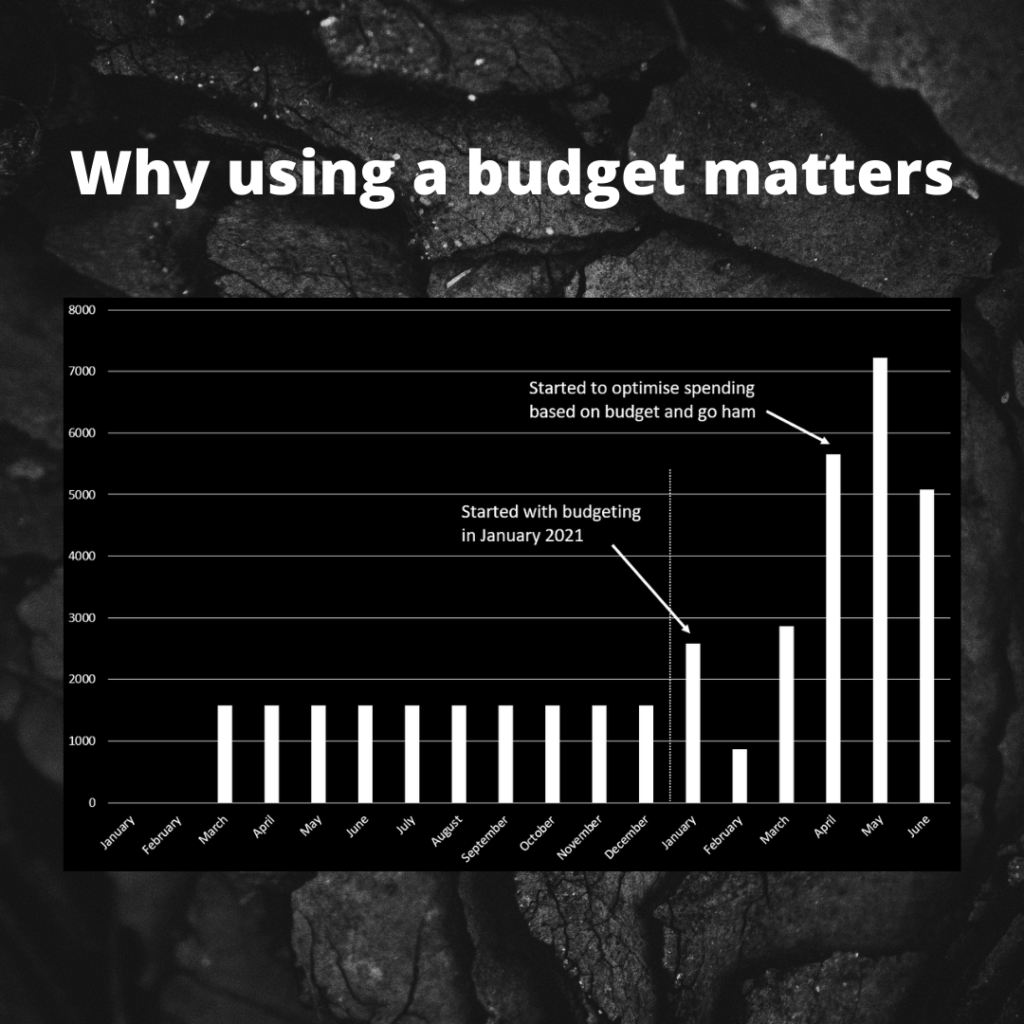

Creating a budget has personally helped me increase my monthly savings rate from CHF 2,000 per month to over CHF 5,000 per month. You ask yourselves how this is possible? I would have never thought that this was possible if I hadn’t experienced it myself.

Graph showing how much I was saving and investing during 2020 and 2021

Retrospection

In March last year (2020), I started investing money in ETFs as well as my individual retirement account (in Switzerland it’s called 3rd pillar and is a voluntary tied pension plan with tax advantages). From March to December, I had consistently bought CHF 1’000.- worth of an S&P500 index fund every month and paid about CHF 580.- into the 3rd pillar. In addition, I paid CHF 1’000.- into a savings account for tax reserves each month.

It wasn’t until January 2021 that I started analyzing my income and expenses in more detail. From January to March 2021, I continued pretty much as I did last year, but started to meticulously writing down every transaction I made. By the end of March, this allowed me to see what and how much unnecessary spending I was doing each month. Additionally, I was able to see how much extra money I could save if I reduced that unnecessary spending. In April, I started to optimize the budget. My savings rate has multiplied since then!

By consciously creating a budget at the beginning of each month, I have already thought very carefully about what income and expenses (both fixed and variable) I will have in the following month and what I will spend my money on. Following this budget then helps me throughout the month to avoid impulse buys, be more conscious with money and thus saving a lot more money than before. But now on to the real question…

What is a budget?

Simply said, a budget is the comparison of your income and expenses and the planning of the same. This conscious comparison creates a plan that shows you how you want to deal with your money in the upcoming month. It shows you how much money you have available for expenses and you can thereby decide very consciously what happens with your money.

Who needs a budget and why do I need a budget?

I generally recommend a budget to anyone who has a monetary goal. It doesn’t matter if the goal is to reduce debt, build up an emergency fund, save for a specific purchase like a car or a downpayment of a house, or just basically save or invest more money. To effectively achieve these goals, it is essential to know what happens to your money and where it goes.

Zero based budget

After clarifying what a budget is and why you need a budget, we will now go into more details about a special type of budgeting that I also use myself: zero-based budgeting.

Zero-based budgeting is a special type of budgeting in which income minus expenses should always add up to 0 when planning. This gives each piece of money a task. With this kind of budgeting you always know exactly where your money goes.

Formula of zero-based budgeting:

Income – Expenses = 0

How do I create a zero-based budget?

1. Write down all income

As a first step, you should write down all your planned income. This includes the salary from your main source of income, but also all the additional income that you earn for example with a side hustle, the sale of items, cash back, dividends, etc.

2. Write down all planned expenses

Then, write down all the expenses you have for that month. This includes expenses for rent, household, parking, gasoline, food, electricity, internet, TV, credit card and much more. I personally plan my expenses very granularly and categorize them into 14 main categories and 76 subcategories. Now if this scares you off, don’t worry! If you want to be a bit more rough at the beginning, that’s no problem either, you can always break down the categories later.

I will write down a detailed list of all categories I track for my income and expenses in the next blog post. If you want to be informed as soon as the new post is online, then sign up for my newsletter on the right side.

Important: make sure that you write down all planned expenses and that you don’t forget any!

3. Make sure that income and expenses balance each other out

In a zero-based budget, income and expenses should always balance out.

Do you have left over money after writing down all your expenses? Cool – then think about what you want to do with this extra money. Each piece of money should have a task. For example, do you want to save or invest more?

If your expenses are higher than your income, you need to think about where you can cut back on spending. For example, you could pay more attention to promotions when shopping and thus save some money. In a later blog post I will show you with which techniques I managed to reduce my expenses by CHF 600. If you want to get informed as soon as the new post is online, then sign up for my newsletter on the right side.

4. Track your income and expenses during the month

A budget is only really useful if you stick to it, and you can only stick to the budget if you know where you currently stand with your income and expenses. For this reason, it is important to track your accrued income and expenses during the month. You can easily keep them in an Excel list or use an app for tracking. If you use an app yourself, then write me in the comments which one, I’m always looking for good apps 🙂

I personally use a detailed budgeting Excel dashboard which, in addition to tracking income and expenses, also provides nicely prepared charts showing interesting metrics such as the development of my capital, the average savings rate, how close I already am to my FI goal (FI stands for Financial Independence) and much more.

5. Compare your budget with actual expenses

At the end of the month, you then compare your budget to your actual expenses.

Do the income and expenses planned at the beginning of the month match the actual ones?

Good job!

Or were there bigger differences?

No problem – learn from it and improve your budget for the next month with the new findings. It generally takes about 3 months until the budgeted and the actual values match closely, so don’t get discouraged!

6. Optimize your budget

At the end of the month, take another look at your expenses during the last month. Do you find expenses that weren’t really necessary? The goal is to identify and avoid these unnecessary expenses next month and thus have more money available for your actual monetary goal.

Conclusion

By using a zero-based budget, I have managed to be much more conscious with my money. I buy less useless stuff and thus have more money available for my current monetary goal: to have CHF 100,000.- invested in ETFs by the end of June 2022.

How are you currently managing your budget? Are you using a budget? Do you plan to create one? Or do you have any more questions about budgeting in general? Then write a comment down below 🙂